As part of Malaysia’s broader digitalisation initiative, the Inland Revenue Board of Malaysia (IRBM) has introduced mandatory e-invoicing for registered businesses. This move is aimed at modernising business processes, improving tax compliance, and boosting operational efficiency across the country.

E-invoicing applies to transactions across the board including Business-to-Business (B2B), Business-to-Government (B2G), and Business-to-Consumer (B2C). As more businesses transition to this system, it’s important to understand how e-invoicing works, when it applies, and how your business can prepare.

What Is E-Invoicing?

An e-invoice is a fully digital invoice that officially records a sale or transaction between a seller (supplier) and a buyer. It replaces traditional documents like printed invoices, credit notes, and debit notes, meaning businesses don’t need to print or email PDFs anymore.

What makes e-invoices different from just a digital file (like a PDF) is that they are:

-

Structured in a specific format (usually XML or JSON),

-

Sent directly to IRBM (LHDN) via the MyInvois system, and

-

Validated in real time, meaning IRBM checks and approves it instantly.

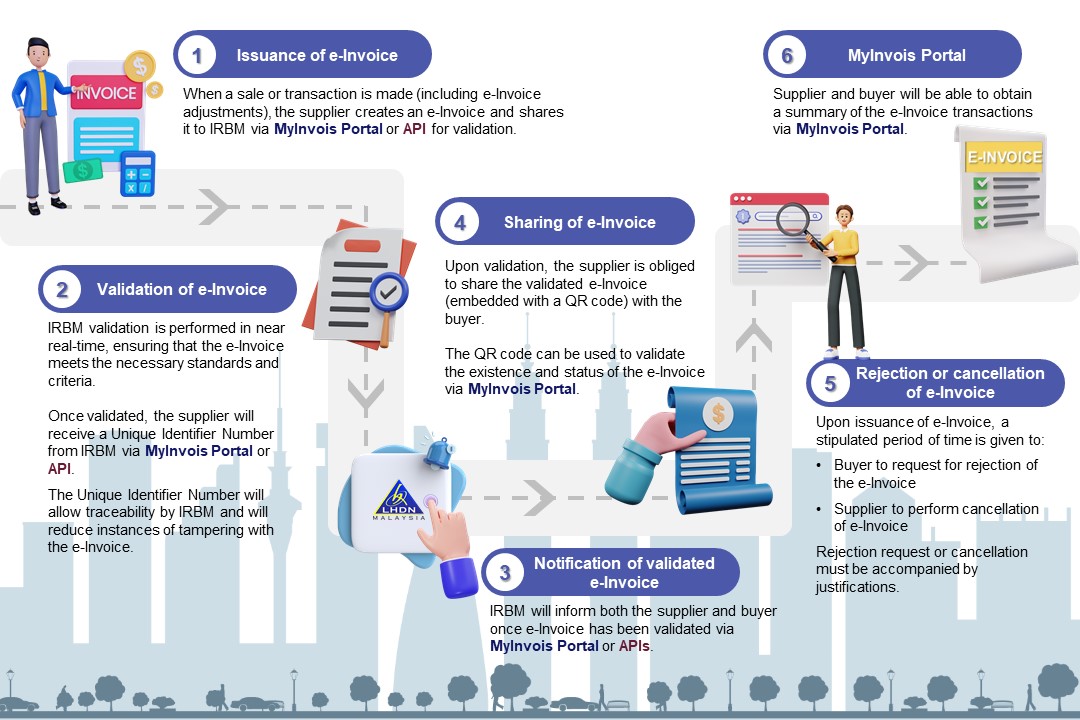

So instead of just issuing an invoice and sending it to a customer, the system now requires you to first send it to IRBM, get it validated, and then pass it to your buyer with proof (like a QR code or unique ID) that it’s officially approved.

E-Invoicing Rollout Timeline in Malaysia

E-invoicing in Malaysia is being implemented step-by-step, depending on how much a business earns in a year (its annual turnover or revenue). Instead of forcing all businesses to start at once, the government is giving different deadlines based on company size so large companies start first, and smaller businesses get more time to prepare.

-

Phase 1 (1 August 2024): Big businesses making over RM100 million per year must start using e-invoicing.

-

Phase 2 (1 January 2025): Medium-to-large companies with revenue over RM25 million must begin.

-

Phase 3 (1 July 2025): Smaller businesses earning between RM500,000 and RM25 million will be included.

-

Phase 4 (1 January 2026): All remaining businesses, including those with less than RM500,000, must follow unless they are officially exempt.

This phased rollout gives businesses time to adapt and make sure they’re ready with the right tools, systems, and processes.

|

Targeted Taxpayers |

Implementation Date |

|

Revenue above RM100 million |

1 August 2024 |

|

RM25 million – RM100 million |

1 January 2025 |

|

RM500,000 – RM25 million |

1 July 2025 |

|

Below RM500,000 (except exempted businesses) |

1 January 2026 |

Benefits of E-Invoicing for Malaysian Businesses

Implementing e-invoicing brings multiple benefits that go beyond just regulatory compliance:

-

Increased Efficiency: E-invoicing saves time by automating tasks like creating, sending, and recording invoices. Businesses don’t have to manually key in details or deal with physical paperwork anymore.

-

Improved Accuracy: Because the system checks invoices in real time, it helps catch mistakes (like wrong totals or missing info) before they’re finalised.

-

Faster Payments: Since the process is quicker and more accurate, businesses can get invoices approved and paid faster which means better cash flow.

-

Environmental Sustainability: Going digital means less printing, less paper, and less waste which is good for the environment.

-

Stronger Compliance: E-invoicing makes it easier to follow tax rules, prepare for audits, and submit accurate records to LHDN.

How to Implement E-Invoicing

Businesses can choose between two official transmission methods, depending on their size and needs:

1. MyInvois Portal

-

This is a free e-invoice portal provided by the government.

-

It’s good for small businesses or those with fewer transactions.

-

You can manually create invoices one at a time or upload a batch using a spreadsheet.

2. API Integration

-

This method is for larger businesses with many transactions.

-

You connect your own system (ERP, accounting, billing) directly to the MyInvois system.

-

It's faster and automated but needs technical setup and IT support.

Whichever method a business chooses, it must make sure its system follows the technical rules set by IRBM, so everything works smoothly and stays compliant.

Start Streamlining Your Invoicing Process with BigSeller

However, transitioning to e-invoicing can pose a few challenges. Small and medium-sized enterprises (SMEs), in particular, may face:

-

High setup or integration costs

-

Staff training needs to manage new digital workflows

-

Technical difficulties, especially for businesses that have not previously used digital invoicing solutions.

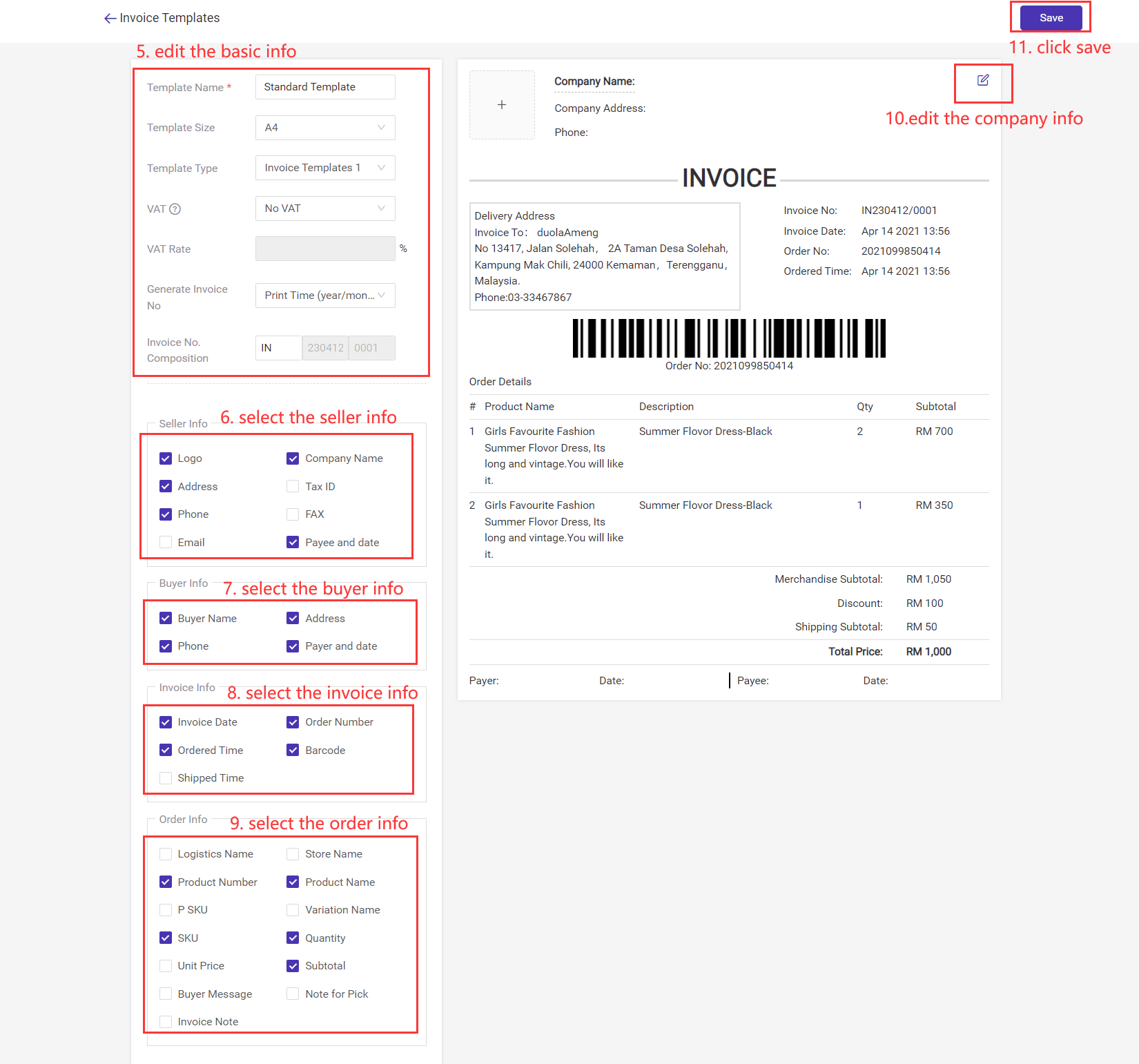

Fortunately, BigSeller can ease this process. As a multi-channel order management platform, BigSeller helps reduce the complexity of e-invoicing where you can:

-

Download recharge invoices with your company’s customised information such as name, address, and tax number, useful for bookkeeping and tax filing.

-

Create and manage up to 20 invoice templates tailored to different stores or needs, complete with your logo and branding.

-

Print invoices for all order statuses including processing, to be picked up, shipped, and completed either individually or in bulk.

-

Integrate invoice generation seamlessly into your order fulfillment process, helping you maintain proper documentation without needing a separate system.

These features help you stay organised, save time, and ensure compliance without the high costs or complexity of traditional ERP systems.

Want to stay ahead of the curve?

Sign up for FREE NOW to try BigSeller VIP Features for 7 Days!

Also, don’t forget to subscribe to BigSeller’s WhatsApp channel for the latest updates and tips on running your online business.