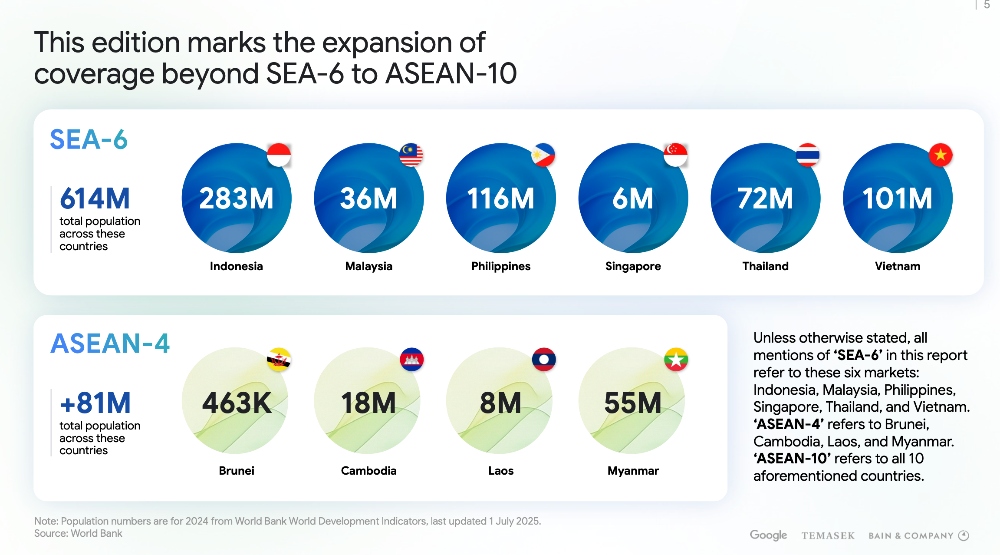

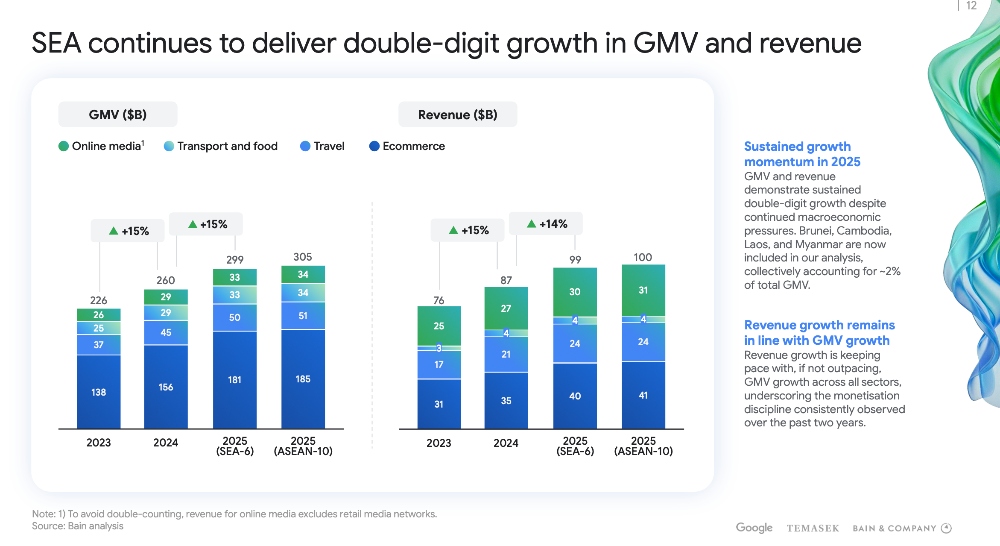

According to the e-Conomy SEA 2025 Report by Google, Temasek, and Bain & Company, Southeast Asia’s digital economy is projected to surpass US$300 billion (RM1.3 trillion) in Gross Merchandise Value (GMV) by 2025, 1.5 times higher than the first forecast made ten years ago.

Revenues are also expected to reach US$135 billion (RM563 billion) as more platforms move toward sustainable profitability. Over the past decade, the region’s GMV has grown 7.4 times, while revenue has grown 11.2 times, showing not just expansion but stronger business fundamentals.

1. The Market is Maturing, Focus on Profitability

Southeast Asia’s digital economy continues to grow steadily at around 15% year-on-year, even amid global uncertainties. This shows that while the market is still expanding, it’s also maturing, meaning competition is no longer just about chasing sales volume.

For Malaysian sellers, this shift calls for a stronger focus on profitability and long-term customer relationships rather than short-term discounts. It’s about improving your margins and building loyalty through strategies such as:

-

Bundle deals that increase average order value,

-

Subscription or auto-reorder options for consumable goods, and

-

Loyalty programs or vouchers that reward repeat purchases.

As growth stabilises, sellers who optimise pricing, operations, and retention will stand out, not those who simply lower prices.

2. Video Commerce Is Powering the Next Wave of Growth

E-commerce remains the core driver of Southeast Asia’s digital economy, projected to reach US$185 billion in GMV by 2025. A major contributor to this surge is video commerce, which now accounts for about 25% of total online sales in the region.

For Malaysian sellers, this signals a clear direction, short-form videos and livestream selling are no longer optional. Shoppers today are drawn to authentic content, relatable creators, and the convenience of buying directly through livestreams or videos.

If you’re already selling on TikTok Shop, Shopee Live, or LazLive, you’re in the right ecosystem. The next step is to refine your content approach, focus on storytelling, product education, and consistent engagement to turn views into loyal customers.

3. Digital Finance and Cross-Border Payments Are Expanding

10 Southeast Asian countries now have national unified QR systems, and 8 have enabled cross-border QR interoperability. In simpler terms, buyers and sellers can now complete transactions more easily across borders using standardised QR payments.

For Malaysian sellers, this marks a new era of frictionless regional trade. It means:

-

Easier access to buyers from neighbouring countries,

-

Faster payment settlements through digital wallets and bank transfers, and

-

Access to new financing options such as Buy Now, Pay Later (BNPL) and embedded lending programs offered by platforms.

This growing financial connectivity reduces barriers for cross-border e-commerce, making it more practical for local sellers to expand beyond Malaysia without dealing with complex payment setups.

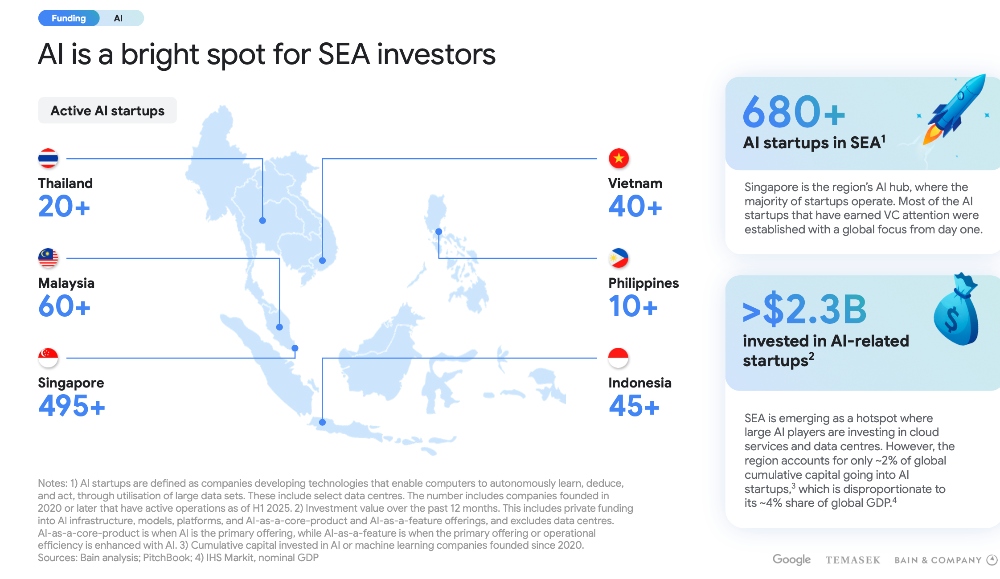

4. AI Adoption Is Accelerating in the Region

Southeast Asia is becoming one of the world’s most active AI markets. Consumer interest in AI is three times higher than the global average, and nearly 80% of workers say they’ve already started using AI tools.

For online sellers, this signals a powerful transformation in daily operations. From AI-generated product titles and descriptions to automated chat replies and sales analytics, AI can now handle much of the repetitive work that slows sellers down.

Even small businesses can benefit from free or affordable AI tools, for example, using AI for keyword optimisation, content creation, or product photo enhancement. The goal isn’t to replace human creativity, but to save time, cut costs, and make better decisions using data-driven insights.

5. Quality Over Quantity, Investors Shift Focus

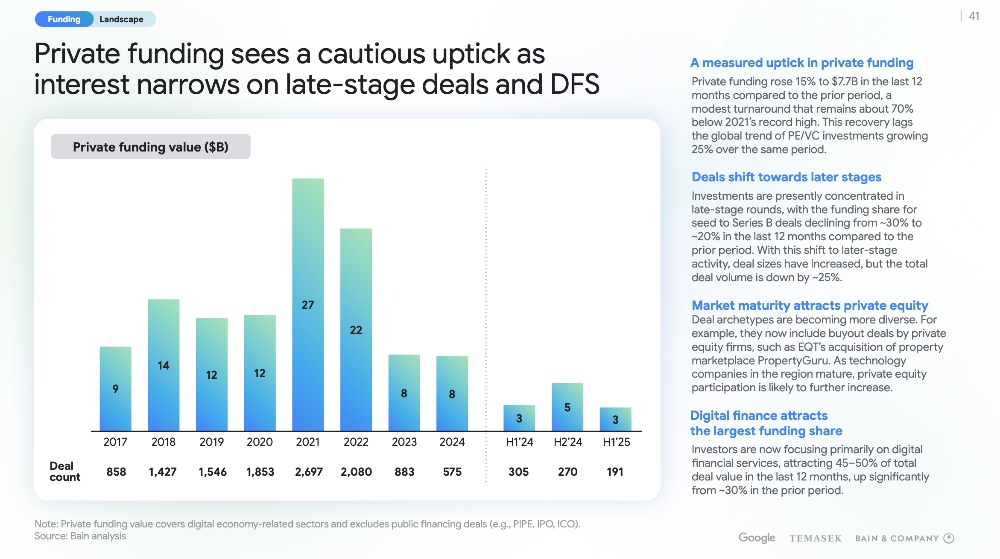

Private funding in Southeast Asia grew by 15% year-on-year to around US$8 billion, but investors are now favouring sustainable, profitable growth over fast but unstable expansion.

For sellers, this mirrors a broader market reality. Platforms and consumers alike are rewarding quality-driven sellers, those who offer consistent service, transparent branding, and a good buyer experience instead of those relying on flash discounts or mass uploads with thin margins.

In this new phase of e-commerce maturity, the winning sellers will be those who operate like sustainable brands, not just temporary stores.

Scaling Smart in Southeast Asia’s Next Digital Decade

The e-Conomy SEA 2025 Report shows that Malaysia’s e-commerce market is maturing fast and competition is no longer about who sells first, but who operates smarter. Sellers who integrate automation, manage multi-platform operations efficiently, and make data-driven decisions will have the edge as the region moves toward a US$300 billion digital economy.

BigSeller supports this new phase of growth by providing Southeast Asian sellers with a free, all-in-one ERP system built for real marketplace challenges, from synchronising product listings to automating order fulfilment and preventing overselling.

Start using BigSeller for free and prepare your business for the next phase of e-commerce growth in 2025.